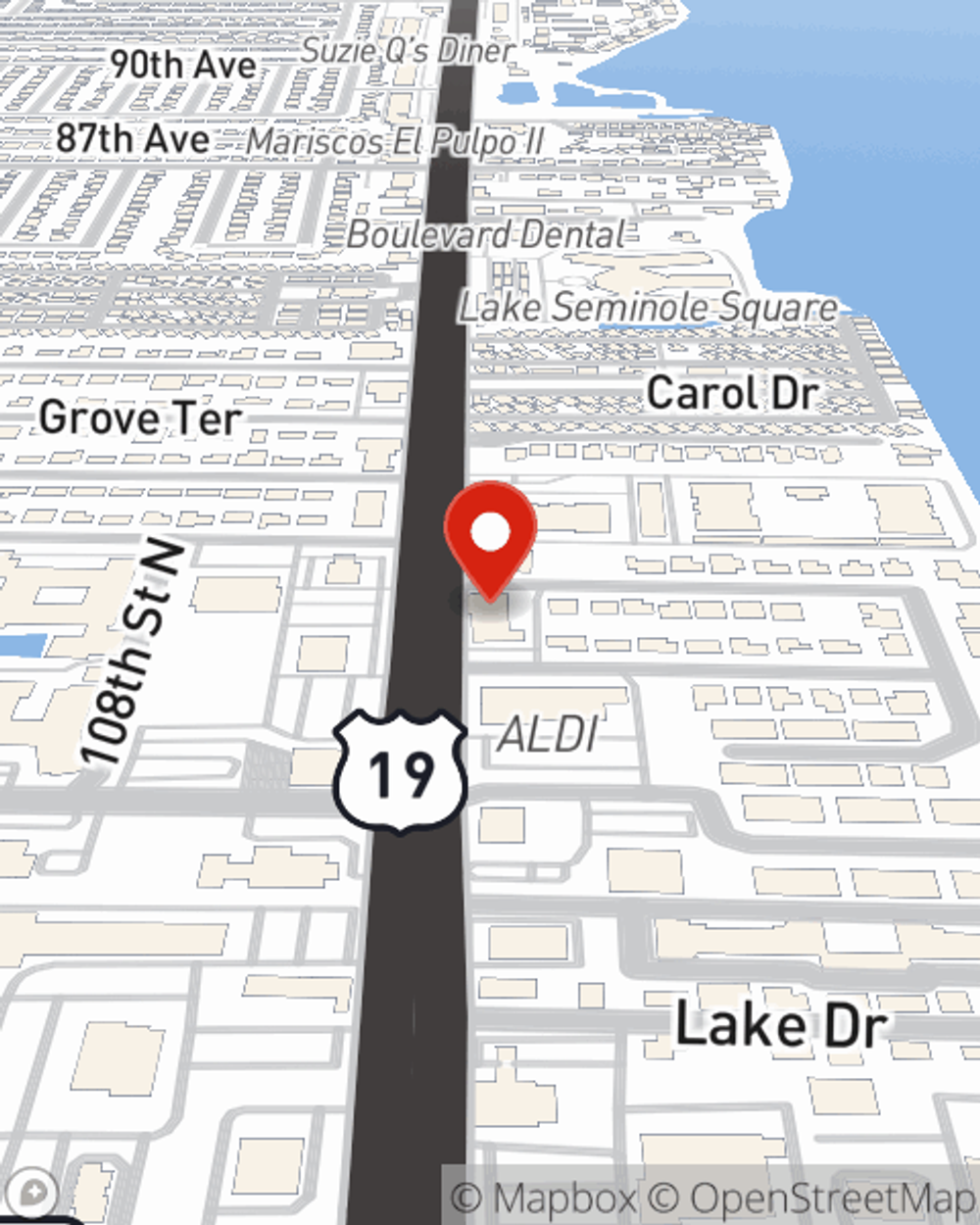

Life Insurance in and around Seminole

Coverage for your loved ones' sake

What are you waiting for?

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

The normal cost of funerals today is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your family to meet that need as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help those closest to you pay for burial costs and not fall into debt.

Coverage for your loved ones' sake

What are you waiting for?

State Farm Can Help You Rest Easy

Fortunately, State Farm offers several coverage options that can be personalized to fit the needs of those most important to you and their unique situation. Agent Ben Feller has the personal attention and service you're looking for to help you select a policy which can aid your loved ones in the wake of loss.

State Farm offers a great option for someone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can be helpful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For more information, contact Ben Feller, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Ben at (727) 391-0876 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.